Our Best

Dedicated Services

My Journey

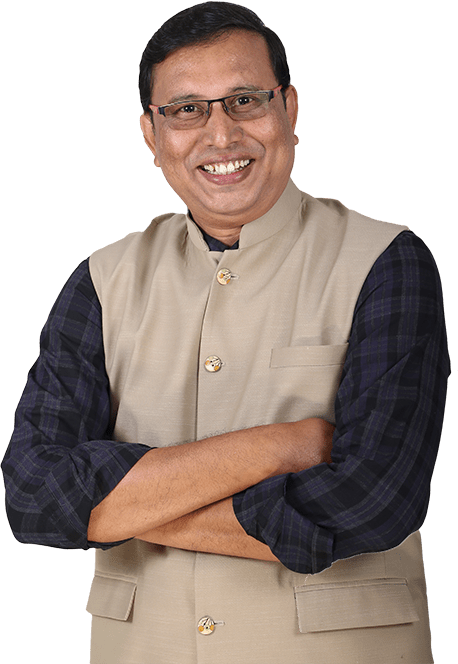

Mr. Rupakumar Pradhan, CFPCM, CWM®

M.A (Eco.), PGDBM (Marketing), PGDCA, LLB, LICENTIATE (III)

While at school, I was an average student with an inclination for new things, new ideas, new concepts, and an eagerness to learn further. Yes, I was not the most talkative student. I have learned some life lessons the hard way, and I accepted some of these hardships by getting into the zone of overconfidence at times.

Yes, During my graduation days, I spend my free time doing tuitions (9th and 10th standard students) to earn some pocket money for myself; this gave me an insight into the world of teaching. That was the time when I developed a love for teaching. I encouraged myself to experiment with learning by education and to share my experiences with the students. Whether you believe it or not, I had my own experience of learning while teaching. Late in my college career, I had some soft corner for teaching in my mind.

After graduation, I have to sharpen my economics knowledge and advice from my elder brother; I joined Ravenshaw University to complete my Post-Graduate in Economics.

START LIVING THE RETIREMENT LIFE OF YOUR DREAM

7 Step Strategy can help and lots of exclusive bonuses

POSITION YOURSELF

Journey With A Purpose

Retirement today is more complex than your previous generation. Your parents’ retirement and your retirement may not be the same. Without a proven strategy to plan for retirement and manage the money you’ve saved, you may feel like you’re all on your own.

You’re not alone-because Rupakumar Pradhan has your back.

Now, in JOYFUL RETIREMENT – The 7 Step Strategy for Healthy, Wealthy, and Early Retirement, he gives you the no-nonsense advice and practical strategies you need to plan wisely for your retirement ever-changing today’s landscape. You’ll find new rules for a reality check, myths vs. reality, design your retirement, early retirement with financial freedom, retirement mistakes, downsizing, spending wisely, healthy, wealthy, and happy habits, and more starting where you are right now.

SOME OF OUR BLOG

Have a look on our latest news

OUR vlogs

Draw inspiration from vlogs you follow

SPEAKING

Mr. Rupakumar Pradhan, CFPCM, CWM® is an inspiring speaker who always speaks with clarity and authenticity.

SPREADING HAPPINESS

Quality education to a needy child

Each book purchase spread warmth to a child in need.