Empowering Women: Understanding the Mahila Samman Savings Certificate and its Benefits

Empowering Women: Understanding the Mahila Samman Savings Certificate and its Benefits

The Mahila Samman Savings Certificate is a government savings scheme that aims to empower women and promote financial inclusion. This unique initiative has been designed to provide women with a secure and reliable means of saving money while offering attractive returns.

In recent years, there has been a growing importance of women’s empowerment and their active participation in the economy. The Mahila Samman Savings Certificate is a powerful tool for achieving these goals. It encourages women to take control of their finances and build a secure future for themselves.

Financial inclusion is crucial in empowering individuals, especially women, who have historically faced financial services barriers. By providing an accessible savings scheme specifically tailored for women, the government is taking significant steps towards bridging this gap and ensuring that every woman has equal opportunities to participate in economic growth.

Introducing the Mahila Samman Saving Certificate, 2023! Starting April 1st, 2023, you can conveniently obtain this certificate at your local Post Office. And here’s the best part – it offers an attractive interest rate of 7.5% annually. It’s advisable to take advantage of this incredible opportunity to grow your savings while supporting women’s empowerment!

In her Budget Speech 2023-24, the Union Finance Minister, Smt. Nirmala Sitharaman announced a new small savings scheme called the Mahila Samman Saving Certificate to commemorate the “Azadi ka Amrit Mahotsav” for women and girls.

The Mahila Samman Savings Certificate, a two-year deposit, is available as a one-time program from April 1st, 2023, to March 31st, 2025, in the Post Offices at an interest rate of 7.5% p.a.

Features of Mahila Samman Savings Certificate

- Government-Backed Scheme

The Mahila Samman Savings Certificate scheme is a fantastic option for those looking to save money, as the government fully supports it. It means that no credit risk is involved, giving you peace of mind and reassurance in your investment.

- Eligibility

The Mahila Samman Savings Certificate scheme is exclusively designed for girl children and women. It offers an excellent opportunity for women or guardians of minor girls to open an account under this scheme and secure their financial future.

Who can open MSSC:-

- By a woman for herself.

- By the guardian on behalf of a minor girl.

- Deposit Limits

The minimum deposit amount under the Mahila Samman Savings Certificate is Rs.1,000 in multiples of rupees one hundred. You can do a maximum deposit amount is Rs. 2 lakh in one account or all Mahila Samman Savings Certificate accounts held by an account holder. A woman or guardian of a girl child can open a second Mahila Samman Savings Certificate account after a minimum gap of three months from the opening of the existing account.

- Maturity

With the Mahila Samman Savings Certificate account, you can rest assured that your investment will yield fruitful results. After a two-year maturity period, you will receive the total amount on your account opening date. Start saving today and experience the benefits in just a short amount of time.

- Withdrawal

The Mahila Samman Saving Certificate scheme offers a convenient partial withdrawal feature. As an account holder, you can withdraw up to 40% of your account balance after one year from the date you opened the account. It allows you to access some of your funds when needed while maintaining a healthy savings balance.

- Interest Rate of MSSC

Unlock exceptional returns with our scheme! Enjoy a fixed interest rate of 7.5% p.a., surpassing the rates offered by most traditional Bank Fixed Deposits (FDs) and other popular small savings schemes. Interest will be compounded quarterly, credited to the account, and paid at account closure. Your interest will be credited quarterly, ensuring steady growth. Take advantage of this opportunity to maximize your earnings!

- Tax Benefits

Unfortunately, investments made under this scheme do not qualify for a rebate under Section 80C of the Income Tax Act. Additionally, any interest earned from this investment is taxable. It means that, unlike tax-saving fixed deposits, you cannot avail of tax benefits from this scheme.

Pay attention to the tax implications of your Mahila Samman Savings Certificate interest income. It’s important to note that this income is not exempt from taxes. The good news is that any applicable TDS (Tax Deducted at Source) will be deducted based on your total interest income and individual tax slabs. Stay informed and plan accordingly to comply with tax regulations while maximizing your savings.

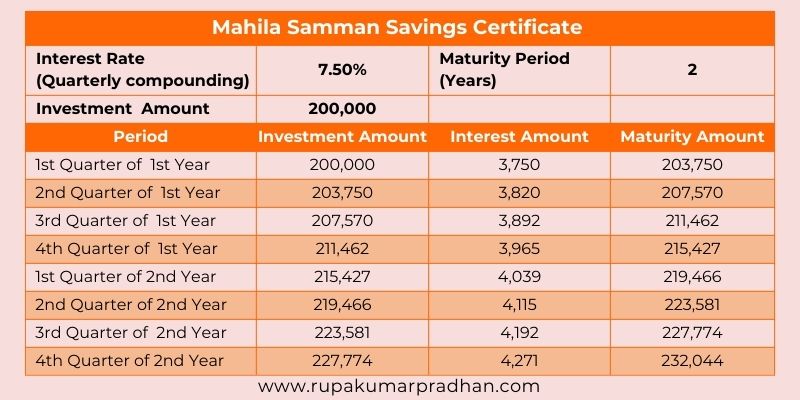

Look at the table below to learn the benefit of opening a Mahila Samman Savings Certificate account.

Suppose you invest Rs. 2,00,000 under the scheme; you get an interest fixed at 7.5% yearly (compounded quarterly). Thus, in the first year, you will get Rs.15,427 interest on the principal amount, and in the second year, you will get Rs.16,617 interest. Thus, by the end of two years, you will get 2,32,044 (2,00,000 initial investment + 32,044 interest for two years). Therefore, your maturity amount, which you get after two years, will be Rs. 2,32,044.

Where to open Mahila Samman Savings Certificate (MSSC) account

You’ll be glad to know that all post offices are now authorized for the esteemed Mahila Samman Savings Certificate Yojana. You can conveniently open an MSSC account at any post office from April 1st, 2023, to March 31st, 2025. Take advantage of this incredible opportunity to secure your financial future!

“Do not save what is left after spending, but spend what is left after saving.” ~Warren Buffett

The Mahila Samman Savings Certificate is a powerful tool that empowers women through financial independence. By providing women with a safe and secure way to save their money, this initiative helps them break free from the cycle of financial dependence and take control of their own lives.

In conclusion, by investing in the Mahila Samman Savings Certificate today, women can take a proactive step towards building a more robust financial foundation. It not only promises attractive returns but also promotes gender equality and empowerment. Don’t miss out on this opportunity to secure your financial future – invest in the Mahila Samman Savings Certificate now!

I am a CERTIFIED FINANCIAL PLANNERCM, CHARTERED WEALTH MANAGER®. For the moment, I have shared my experience growing up with you because it had a tremendous impact on how I do what I do. If you have a question about your financial situation, please connect me. I would be delighted to try to be of service.

Don’t miss any future posts; please subscribe via email.

Hello! Connect With Mr. Rupakumar Pradhan, CFP, CWM Contact Form Link:https://forms.gle/dhuYuUp7Uri5cB9U9

Mind Your Money: How Your Mindset Impacts Your Finances, Read it.