Modern days oxygen means petrol; whether we like it or not, we must accept that petrol rates are high in India. Petrol has become the oxygen of our day-to-day life, and we can’t live and imagine our life without it. But the petrol prices are skyrocketing, which is Rs. 103.19 in Bhubaneswar and Rs. 96.72 in New Delhi today. In 2003, the petrol price was Rs. 32.49 in Delhi, which is three times now.

Modern days oxygen means petrol; whether we like it or not, we must accept that petrol rates are high in India. Petrol has become the oxygen of our day-to-day life, and we can’t live and imagine our life without it. But the petrol prices are skyrocketing, which is Rs. 103.19 in Bhubaneswar and Rs. 96.72 in New Delhi today. In 2003, the petrol price was Rs. 32.49 in Delhi, which is three times now.

In general, it is eventually going to affect each and everything that we use in our day-to-day life. It involves the prices of essential daily commodities, which are transported daily. An increase in fuel prices will also increase food and other costs.

Yes, this will have a more severe impact on poor people. In India, poor households spend more than half of their income on food and minimal fuel. It is a chain reaction and, once started, will affect all.

All goods and services prices will increase due to this effect. In simple, It means the inflation rate. The Inflation rate was 7% in August 2022, which was on the higher side. RBI is taking necessary monetary policy steps to manage the current scenario’s inflation rate.

What is inflation?

Inflation means the increase in the prices of goods and services over a given period. In simple understanding, you have to spend more to fill your car’s petrol tank, buy a packet of milk, or get a haircut. In another way, your cost of living increases due to the impact of inflation rise.

Inflation reduces the purchasing power of each unit of the Indian rupee. As all goods prices rise, your hard-earned money buys less quantity. It acts to reduce your standard of living over time. Think about the corpus required for your retirement living cost after 25 or 30 years.

Is it making any impact on your savings and investments?

Yes, inflation and taxes are two silent killers.

They will make a corrosive impact on your assets or investments. Sometimes you may not be able to know about its impact. You may also not see the negative impact on even your saving account balance.

According to official data, the annual inflation rate in India increased to 6.95 percent in March 2022, the highest since October 2020. Similarly, the wholesale price index in March, at 14.5 percent, was the second highest since 2012.

You cannot ignore the negative impact of rising prices on your investments.

For example, Rs 100 earned will be worth just Rs 94 after one year if the inflation rate is 6% pa and it is not invested. Due this reason, you should be on the lookout for investments whose returns are more than the current inflation rate. It would best you don’t ignore your savings account balance if it’s a considerable amount.

Let’s discuss this with an example.

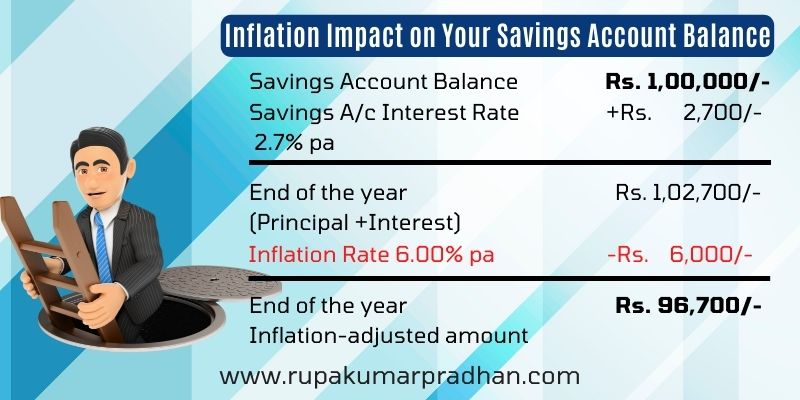

Suppose you have an Rs. 1,00,000 balance in your savings bank account for a year, and the interest rate is 2.7% per annum (SBI Savings Account Interest Rate 2022). End of the year, you will receive the interest amount of Rs. 2,700/- for one year. You will get Rs 1,02,700/- (Principal amount Rs. 1,00,000/- + Interest amount Rs. 2,700/-) in your savings bank account.

What is the impact of the inflation rate, say 6% pa, on your savings account balance?

This 6% pa inflation will hurt your savings bank account balance. It means you will lose Rs. 6,000/- the value of your Rs. 100,000/- balance in your savings account.

End of the year, your value will be Rs. 96,700/- (Rs. 1,02,700 – Rs. 6,000/-) even if you are earning interest in your savings account. You see an Rs. 102,700/- balance in your savings account at the end of the year. But the actual value of the money is Rs. 96,700/- due to the impact of inflation of 6% pa. It means your money, Rs. 102,700/- lost its purchasing power due to inflation. It’s a silent killer of your money, whether savings account or kept at home, or invested. In the same way, the inflation rate will also impact all other investments you have.

End of the year, your value will be Rs. 96,700/- (Rs. 1,02,700 – Rs. 6,000/-) even if you are earning interest in your savings account. You see an Rs. 102,700/- balance in your savings account at the end of the year. But the actual value of the money is Rs. 96,700/- due to the impact of inflation of 6% pa. It means your money, Rs. 102,700/- lost its purchasing power due to inflation. It’s a silent killer of your money, whether savings account or kept at home, or invested. In the same way, the inflation rate will also impact all other investments you have.

Suppose you save money by burying it in jars in your backyard or by stuffing it under your bed. In that case, you will lose to inflation because the cost of living grows while the value of your money does not. It’s the hard truth about your money.

When looking at investments, always focus on the real return or the return net of inflation.

“Equity is one of the asset classes that help you to beat inflation over a long period if you want to stay ahead of inflation.” in my opinion.

Historically, if you hold on to your equity investments for seven years, the probability of making a loss is zero. If you want to say ahead of inflation, you should invest in equities over a long period, which is one of the best ways.

Over the last ten years, the Nifty has returned 16.7% a year compared to the 7% average inflation rate. In the previous 38 years, Sensex has returned 16% per year.

Another way of lowering the overall risk is investing via systematic investment plans (SIPs) in Mutual funds. The compounding impact of such investments over long periods will help you beat inflation by a comfortable margin.

Many of our clients are convinced about this and always try to beat inflation. Whether a child’s higher education planning, retirement planning, or other financial goals, they make long-term investments through Mutual Fund SIPs. Most importantly, they prepare their “Comprehensive Financial Plan” and move according to the plan to achieve their financial goals and freedom.

Clients believe in the ‘Comprehensive Financial Plan’ concept and its power. However, their commitment and time around (4-5 hours of discussion) for the entire process of Comprehensive Financial Planning is helping them to move in the right direction. It helps them learn about inflation’s impact on their financial journey.

Beat Inflation

Building a mutual funds portfolio is similar to building a house. To make your house, you will use many strategies, designs, tools, and building materials. But remember that each building structure and design share some basic features and benefits.

In investing to beat inflation, you have to build the best mutual funds portfolio, and you must go beyond the wise say, “Don’t put all your eggs in one basket.”

A structure that can withstand the long run requires an intelligent design and a strong foundation. Similarly, keep in mind your investment objectives, financial goals, and risk profile when investing; a mutual funds portfolio works well for your needs.

“Inflation is taxation without legislation” ~ Milton Friedman

Understand diversification

Diversification means investing in the different asset classes and also in various mutual funds as your investment objectives.

Most investors think that spreading money among several mutual funds means they have an adequately diversified portfolio. However, being different does not mean being diverse. Be sure you have exposure to the various categories of mutual funds.

You can do it in several ways:

-

-

- With Growth Stock Funds

- Dividend Paying Stocks

- With Foreign Stock Funds or Mutual Funds

- Inflation-Indexed Bond

- Gold and Real Estate

-

Despite the impact of inflation, it would be helpful to invest in a diversified mutual fund portfolio that will keep your savings positive and help you attain your financial goals.

Disclaimer: Mutual Fund investments are subject to market risks; read all scheme-related documents carefully.

My continuous mentoring will make you make an informed decision about your financial goals and move accordingly.

A penny saved is a penny earned.

Keep Investing! Keep Inflation Beating!

I am a CERTIFIED FINANCIAL PLANNERCM, CHARTERED WEALTH MANAGER®. For the moment, I have shared my experience growing up with you because it had a tremendous impact on how I do what I do. If you have a question about your financial situation, please connect me. I’d be delighted to try to be of service.

Don’t miss any future posts; please subscribe via email.

No More Mistakes with Child Education Plan, Read it.