44 Years SENSEX Return- 15.60% Per Year

Indian equity market delivered good returns in the last 44 years. As of 31st March 2023, Sensex closed at 58,991.52 points.

BSE completed 44 years since 1979-80 (base year). But what is the return per Year? Does the SENSEX give a good return per Year in the long term?

Why 1979-80 years? This is the base year of the Sensex. That is the Year from which Sensex came into existence with the base as 100.

I will explain the yearly return Sensex delivered in the last 44 years. Assuming an initial investment of Rs. 100,000, the current value as of 31st March 2023 is Rs. 8.60 crore.

If we considered dividend yield in addition to capital appreciation for Sensex, the future value would be more than Rs. 8.60 crore. Assuming a dividend yield per annum of 1% on average, the Sensex returns worked out to Rs. 9.70crore.

The decision to invest in equity has yielded remarkable results, producing a return that is equivalent to 589.91 times the initial investment.

Sensex has seen multi-fold returns over the past 44 years, as the 30-Stock Index rallied from the 100 level in 1979 to 58,992 on 31st March 2023. Investing in equity or equity-related schemes can be a great way to combat inflation and build wealth. Understandably, financial decisions can be overwhelming, but it’s essential to consider all options and make informed choices for your financial future. I’m here to assist you with any questions or concerns.

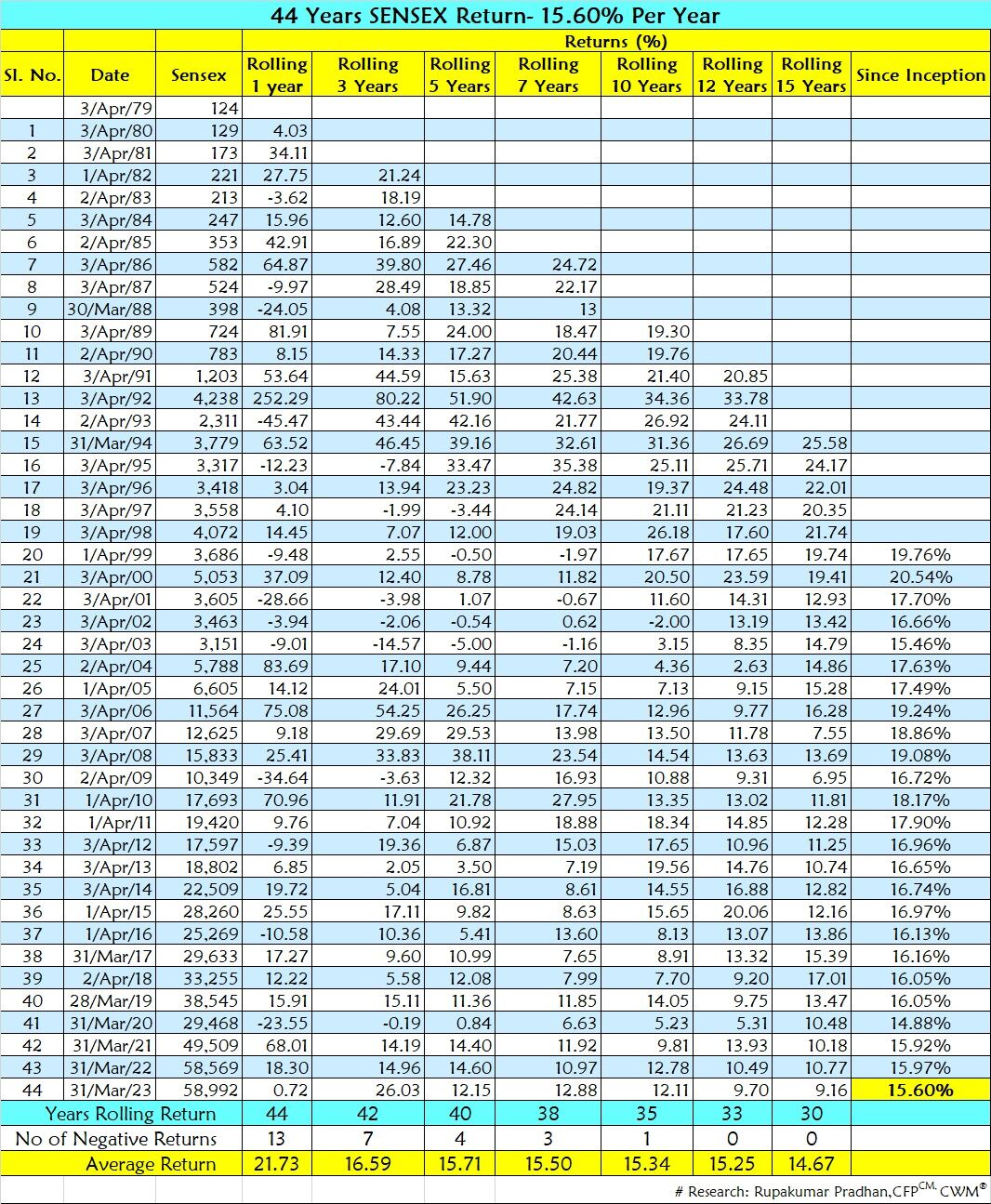

44 Years SENSEX Return – 15.60% Per Year. (See the below table)

Yes, Sensex has delivered a 15.60% yearly return since its inception.

In the last 44 years, Sensex has given a compound annual Growth Rate (CAGR) of 15.60%. But the journey has been a volatile one. In the last 44 years

- 44 years have given a positive return [Averaging (+) 38.08%]

- 13 years have shown a negative return [Averaging (-) 17.27%]

You can compare this Sensex return with other asset classes -Fixed Deposit, Gold, Silver, etc. Check other asset classes per Year return? And also the impact of inflation and taxation on each asset class return. Remember, inflation and taxation are two silent killers of your wealth.

Planning for retirement is a crucial step in ensuring financial security and peace of mind in our golden years. One of the key decisions in this process is choosing the right investment vehicles to grow our retirement fund. Mutual funds and equity investments are two popular options that offer potential growth and long-term wealth accumulation.

If you’re a millennial or nearing retirment, striving for a secure future, “JOYFUL RETIREMENT: The 7-Step Strategy for Healthy, Wealthy, and Early Retirement” could be the perfect solution. With this book, you can feel empowered to create a retirement plan that gives you confidence and peace of mind.

If you’re a millennial or nearing retirment, striving for a secure future, “JOYFUL RETIREMENT: The 7-Step Strategy for Healthy, Wealthy, and Early Retirement” could be the perfect solution. With this book, you can feel empowered to create a retirement plan that gives you confidence and peace of mind.

Taxation impact for each asset class and your wealth; we can work out the return after taxes. FD would automatically turn negative. Gold and Silver would have provided a slight recovery. Only equity would have provided a real rate of return of around 9% per annum.

Suppose you have lost an opportunity to make money in the last 42 years when stocks and the Sensex (stock market) have multiplied many times. In that case, you need to be disciplined and become an investor rather than a spectator or trader.

Investors who missed this wealth-creation opportunity should invest now.

Disclaimer:

The opinions expressed above belong solely to the author. Any data and charts used have been acquired from publicly available sources and have not been verified by any regulatory body. Neither the author nor www.rupakumarpradhan.com claim its accuracy or assume any liability. These views solely represent personal opinions and should not be construed as guidelines or recommendations for any action to be taken by the reader. We encourage you to read the website’s detailed disclaimer for more information.

In conclusion, the SENSEX has proven to be a reliable and profitable investment tool for those looking to achieve long-term financial success and wealth creation. By understanding the key principles of long-term investing and leveraging the power of SENSEX, investors can navigate through market volatility and capitalize on growth opportunities.

The SENSEX provides a comprehensive view of the Indian stock market, representing some of the largest and most influential companies across various sectors. Its performance over time has demonstrated its ability to generate substantial returns for patient investors who stay committed to their investment strategies.

“The stock market is a device for transferring money from the impatient to the patient.” ~Warren Buffett

By adopting a disciplined approach to investing in SENSEX, individuals can benefit from compounding returns over time. This means that even small investments made consistently can grow significantly over the long run. Moreover, by diversifying their portfolios across different sectors represented in the SENSEX, investors can mitigate risks associated with individual stocks or industries.

It is important to note that successful long-term investing requires patience, discipline, and a thorough understanding of one’s financial goals. It is not about timing the market or chasing short-term gains but rather about having a well-defined investment plan that aligns with one’s risk tolerance and objectives.

In summary, harnessing the potential of long-term investing with SENSEX offers individuals an opportunity to build wealth steadily over time. By staying informed about market trends, conducting thorough research on potential investments, and seeking professional advice when needed, investors can make informed decisions that contribute to their financial success. With dedication and perseverance, anyone can tap into the power of SENSEX for long-term financial growth and prosperity

Unlock Your Financial Potential – Become an Investor Today!

I am a CERTIFIED FINANCIAL PLANNERCM and CHARTERED WEALTH MANAGER®, dedicated to helping my clients achieve financial freedom and experience the joy of being in the HappyMoney Zone. For the moment, I have shared my experience growing up with you because it had a tremendous impact on how I do what I do. If you have a question about your financial situation, please connect me. I would be delighted to try to be of service. Don’t miss any future posts; please subscribe via email.

Hello! Connect with Mr. Rupakumar Pradhan, CFP, CWM, by filling out the form linked below. Form Link:https://forms.gle/dhuYuUp7Uri5cB9U9

Is It Necessary To Know Your Net Worth?, Read it.