Inflation is a persistent economic force that can profoundly impact your hard-earned money and investments. Staying ahead of the curve and developing solid investment strategies to safeguard your wealth against inflationary pressures is crucial. Inflation is an economic phenomenon that affects the purchasing power of money. It can significantly impact your investments and savings, eroding your money’s value.

Inflation is a persistent economic force that can profoundly impact your hard-earned money and investments. Staying ahead of the curve and developing solid investment strategies to safeguard your wealth against inflationary pressures is crucial. Inflation is an economic phenomenon that affects the purchasing power of money. It can significantly impact your investments and savings, eroding your money’s value.

With the increasing prices, the purchasing power of your money decreases significantly. It means you can purchase fewer goods and services than before with the same amount of money. Keeping a close eye on rising prices is important to ensure your finances are not negatively affected in the long run. It means you must consider inflation when making financial decisions to avoid losing out in the long run. This article will explore how inflation works and how it can affect your investments and money management strategies.

What is Inflation?

The prices of goods and services of daily use items, like food, grocery items, clothes, transport, rent, recreation, etc., increase over time, called inflation. It is why we can buy less quantity for the same amount.

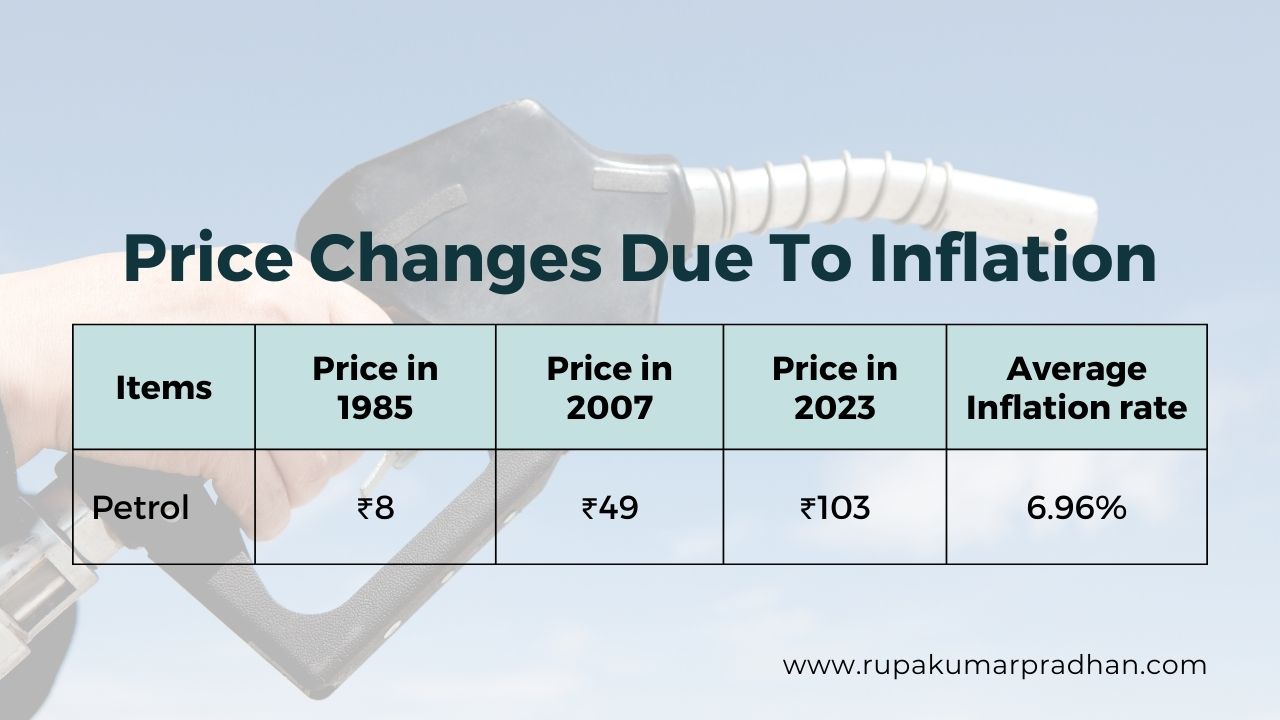

Let us understand with an example why inflation is bad for all. The value of money has drastically changed over the years, impacting our purchasing power significantly. In 1985, with just Rs. 100, one could buy 12.5 liters of petrol; in 2007, the same amount could only fetch a mere 2 liters. This staggering difference highlights the impact of inflation and the importance of understanding how it affects our daily lives. Meanwhile, with Rs 100, you can buy less than a liter of petrol today. That is how the same Rs. One hundred lost its value over time due to inflation. We have discussed only one item, but other items’ prices also increased due to the impact of inflation, and the inflation rate is also different for each item in India.

Let’s see the table below to understand how petrol prices have increased.

Inflation is a force that can erode the value of your investments over time. If your assets are not keeping up with inflation, they may lose value in real terms, despite showing nominal gains. It is important to consider inflation when making investment decisions to ensure that your investments maintain their purchasing power and retain their value over time.

Investing is a way to grow wealth and secure a comfortable financial future. However, various factors can cause concern for investors, especially those new to the game. Market uncertainty, fluctuating interest rates, and economic instability can all impact investment outcomes. Investors must stay informed and aware of potential risks before making investment decisions. It will safeguard their financial future and help them make informed choices that align with their long-term goals.

It would help if you recognized the impact of inflation on your investments. It erodes the value of money over time and can significantly reduce the purchasing power of your investment returns. However, some strategies can help investors mitigate the effects of inflation and maintain their financial security. Investors can safeguard their portfolios and generate long-term growth by proactively managing inflation.

Inflation can be a major concern for investors looking to grow their wealth over time. As the costs of goods and services continue to rise, it can be challenging to maintain the value of your portfolio. It can hinder your ability to achieve financial success and reach your long-term goals. However, by taking certain steps, you can protect your portfolio from inflationary pressures and continue to grow your wealth over the long term. In this article, we’ll explore some strategies you can use to safeguard your investments and stay ahead of inflation.

Here are some strategies you can consider to implement

1. Increasing Your income

One strategy is to increase your income by negotiating for a raise or taking on additional work.

In today’s world, where the cost of living is constantly rising, increasing one’s income has become a top priority for many. While there are various ways to achieve this goal, one effective strategy is to focus on negotiations for a raise or taking on additional work. Putting time and effort into these areas can increase income and financial stability. It would help if you researched what skill to add yourself to increase your payment in the future.

2. Reduce Your Expenses

Another strategy is to reduce our expenses by cutting back on non-essential items and finding ways to save money.

In today’s world, where the cost of living is skyrocketing, finding ways to save money has become essential. One of the best ways to do this is by cutting back on non-essential items and expenses. Doing so can save money, simplify our lives, and reduce our stress levels.

3. Investing Your Money

Investing in assets that you appreciate is an ideal way to secure your financial future. These assets can provide significant returns and help you build wealth. One of the most popular investment options is the stock market, where investors can buy shares of companies and benefit from their growth. Mutual funds are another option allowing investors to diversify their portfolios and reduce risk while enjoying the benefits of appreciation over time. In this way, investing in appreciating assets can be a strategic move for anyone looking to grow their wealth and achieve financial freedom.

If you want to prevent the loss of your money, saving is not enough. It is because most saving instruments like saving bank accounts, fixed deposit or PPF (Public Provident Fund) give returns that don’t consistently beat inflation. Investing in them might grow the corpus, but that money’s purchasing power will be lower.

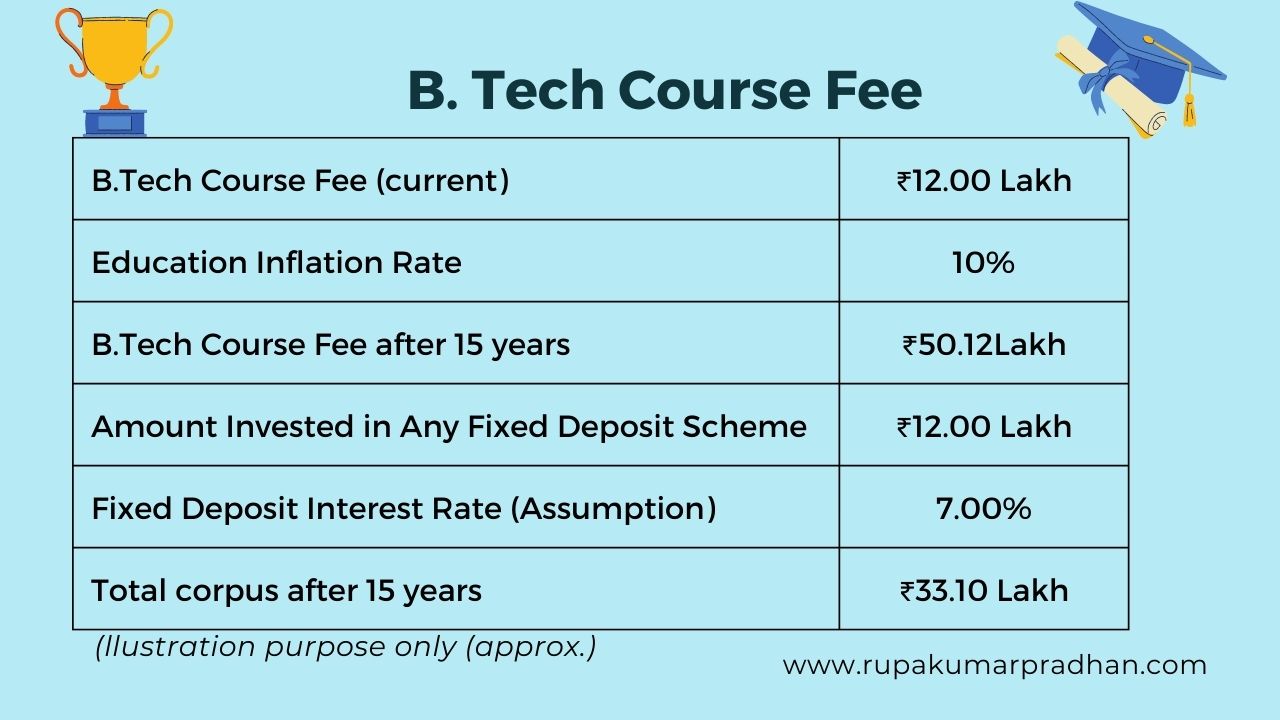

Let’s take an example. Suppose you have money and want to put it away for 15 years for your children’s education. Today, a B.Tech course costs around Rs. 12 lakh; for simplicity, we assume you have the same amount. And you put that money in any fixed deposit scheme. At the end of 15 years, you will have Rs. 33.10 lakh (Assumed fixed deposit rate of 7.00% pa.). But the cost of that same B.Tech Course will be Rs. 50.12 lakh at that time because its price is going up by 10% yearly.

Let’s take an example. Suppose you have money and want to put it away for 15 years for your children’s education. Today, a B.Tech course costs around Rs. 12 lakh; for simplicity, we assume you have the same amount. And you put that money in any fixed deposit scheme. At the end of 15 years, you will have Rs. 33.10 lakh (Assumed fixed deposit rate of 7.00% pa.). But the cost of that same B.Tech Course will be Rs. 50.12 lakh at that time because its price is going up by 10% yearly.

Did you see what happened in this situation? It’s important to consider your current finances and future when planning for a goal. More than having the funds today is required, as inflation can significantly impact their value over time. By ensuring that your money grows at a rate equal to or greater than inflation, you can be confident in achieving your goals without any financial roadblocks.

While inflation may be inevitable, we can mitigate its effects by being proactive and strategic in our financial decisions.

Inflation-proof your wealth, today.

I am a CERTIFIED FINANCIAL PLANNERCM, CHARTERED WEALTH MANAGER®. For the moment, I have shared my experience growing up with you because it had a tremendous impact on how I do what I do. If you have a question about your financial situation, please connect me. I would be delighted to try to be of service.

Don’t miss any future posts; please subscribe via email.

Hello! Connect With Mr. Rupakumar Pradhan, CFP, CWM Contact Form Link:https://forms.gle/dhuYuUp7Uri5cB9U9

Never Lose Your Money Mindset Again. Read it.