Unlocking the Best Kept Secrets: How to Become a Crorepati with a Nominal Income

Unlocking the Best Kept Secrets: How to Become a Crorepati with a Nominal Income

What does it take to get my first ‘One Crore’ in savings? How to accumulate it? Is it possible to create once crore worth assets in my lifetime? How does one become a crorepati? What are the secrets of achieving it? Is it possible to become a crorepati with a nominal income of Rs. 15,000/ – or Rs. 20,000/- per month?

I interacted with many people across different strata of society who come to me for personal financial advice and financial planning. They asked me if I could become a Crorepati in life and also in a happy money zone. The majority of them want to enjoy life and create wealth with a nominal income. It’s a question that remains dominant in the interaction.

One common question I come across is how to become a crorepati?

I want to provide an answer for this question through this article, as to how to make one crore and much more, practical ways to become a crorepati with nominal income per month.

Many individuals would dream of becoming crorepati. However, only a few would plan and achieve. Many of us struggle throughout our lives to ensure that we can become one, and until and unless one is a big corporate honcho or high profile businessman, such a dream remains a dream for the ordinary middle-class Indian.

My primary aim of this writing is to show you how an ordinary person can become a crorepati in his lifetime, provided he has a sound financial plan and, more importantly, the willingness to implement that plan systematically and follow the procedure with a mindset to achieve it.

Crorepati = 100 lakhs

10 Million Rupees

It’s a significant amount for a middle-class family. Yes, it’s a considerable amount.

Many of us first start earning money, maintaining the desired lifestyle, making small savings, and then trying to make several lakhs and become crorepatis. However, if your target amount is one crore, consider your required interest rate and investment time horizon. Do you want to achieve it through one-time investment (lump sum) or small amount investing regularly? First, please ask yourself this question.

Check out how you can massively grow your money by investing a fixed lump sum amount annually or monthly for a particular period of years at a fixed rate of return.

If you want to become a crorepati in 5 years, you have to invest Rs. 102,398/- every month.

If you want to become a crorepati in 10 years, you have to invest Rs. 29,739/- every month.

If the time horizon is 20 years, then the investment amount per month is only Rs. 4,267/- for creating one crore. If you invest Rs. 30,000/- mentioned above for 20 years; then you would have a whopping amount of Rs. 7,03,04,616 (Rs. 7.03 Crore).

If you can increase the period to 25 to 30 years, the monthly investment comes to only 1,717 and Rs. 698/- respectively for achieving one crore.

If you want to invest a one time amount to achieve a target of Rs. 1 crore, then the investment amount is:

Rs. 43,71,092 (43.71 Lakhs) Lakhs for investment tenure of 5 years

Rs. 19,10,645/- for investment tenure of 10 years

Rs. 8,35,160/- for investment tenure of 15 years

Rs. 3,65,056/- for investment tenure of 20 years

Rs. 1,59,569/- for investment tenure of 25 years

Rs. 69,749/- for investment tenure of 30 years

I have assumed an annualized return of 18% for the above calculations.

During the last 44 years, Sensex has given a 15.60% annualized return. Compared to it, gold has delivered an annualized return of just 6-7%. While bank deposits are currently giving around 5.40 percent for ten years fixed deposit. For the past 20-25 years bank interest rate scenario, rate of interest is decreasing year on year basis. In the past diversified equity mutual funds have provided returns far superior to the Sensex.

Disclaimer: Mutual Fund investments are subject to market risks; read all scheme-related documents carefully.

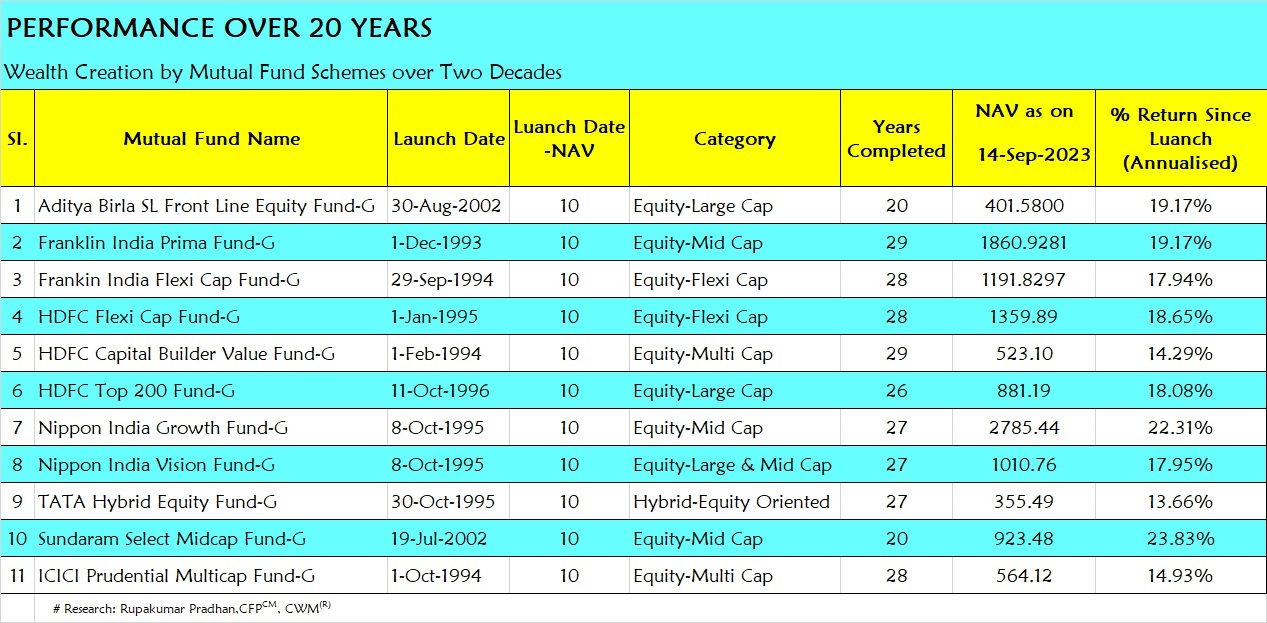

India’s equity mutual fund schemes, with over two decades of track record, have made hefty wealth for investors. Investments made through the monthly systematic investment plans, popularly known as SIPs, are at multi-fold valuations currently.

In my opinion, your investment horizon should be a minimum of 20 years or more. Whenever you are going to invest in equity mutual funds, please check your investment horizon, risk appetite, financial goals, right fund selection, etc. You will get a higher return on long-term equity investments. However, an investment for 20 years may make you wealthy beyond your imagination.

For illustrative purposes:- I have calculated annualized return (CAGR) for some equity mutual funds to give you all some ideas about mutual funds’ past returns. Please go thru the below table to know the annualized return. In the Indian mutual fund market, some other funds have completed ten years, but we have taken some funds to know about the annualized return in mutual fund schemes.

This explains the fact that the longer the investors stayed, the more is the wealth creation, irrespective of the market fluctuations. The Indian mutual fund sector, still considered to be in a nascent stage, given the poor penetration of its products, is home to several schemes which have a reasonable and respectable performance chart for a period exceeding 18-20 years with annualized return (CAGR) of 13.95% to 24.53%. All these are 10-year-plus funds and have made handsome annualized returns of as high as 24.53 percent for investors.

Mutual fund schemes provide good returns in the long term. One can consider the average annualized return of 12% to compute the wealth that can get accumulated in the long run if one is ready to invest every month through SIP.

If you start at the age of 25 and want to become a crorepati at 60 age (35 years tenure), you just need Rs. 1540/- per months SIP.

Invest in equity mutual funds early if you want to benefit from the Power of Compounding. If you start late, you will have to increase your SIP amount to your Rs. 1 crore target. Let’s consider the following scenario, wherein you wish to become a crorepati at age 60 and are investing in an equity mutual fund with a rate of return of 12 percent per annum –

- If you are 20 years of age, and your goal is to accumulate Rs. 1 crore by the time you turn 60, then you have to invest just Rs. 842 per month.

- If you are 30 years old, you have to invest Rs. 2,833 per month to achieve the target of Rs.1 crore in 30 years

- If you are 40 years old, you have to invest Rs. 10,009 per month to reach the target of Rs. 1 crore in 20 years.

Apart from this, the most significant advantage of equity is taxation benefits. Gains after one year from equity are considered long-term capital gains and taxable, but Long-term capital gains tax in equity funds is 10%, provided the gain in a financial year is over Rs 1 Lakh.

In the case of debt investments like fixed deposits, the interest is added to the investor’s income and taxed as per the slab.

So, a person falling in the highest tax bracket (say 30 percent) will get only around four percent interest in a fixed deposit.

Investing in a lump sum is very difficult for a middle-class family or nominal income-earning members in India. But everyone is and should be capable of investing small monthly sums over a long period.

We want to show you how different rate of return in your mutual fund scheme helps you to grow your wealth and achieve your financial goals. Say 12%, 15% & 20% rate of return.

Rate of return -12% pa, Rs. 5000/- investment per month:-

- If you invest 5000 pm for ten years, how much would its value be? Guess? It is Rs. 11.61 Lakhs. You would have invested Rs.6 Lakhs over ten years resulting in a close to 2-fold rise in the capital.

- If you invest 5000 pm for 15 years, how much would its value be? It is Rs. 25,22,880. You would have invested Rs.9 Lakhs over 15 years – close to 3 fold rise in the capital.

- If you invest 5000 pm for 20 years, how much would its value be? Check it. It is Rs. 49.95 Lakhs. You would have invested Rs.12 Lakhs over 20 years – 4 fold rise of capital.

- If you invest 5000 pm for 25 years, how much would its value be? Hold your breath; It is Rs. 94.88 Lakhs. You would have invested Rs.15 Lakhs over 25 years- 6 fold rise of capital.

- If you invest 5000 pm for 30 years, how much would its value be? Wow! It is Rs. 1.76 Crore. You would have invested Rs.18 Lakhs over 30 years- close to 10 fold rise in the capital.

Rate of return -15% pa, Rs. 5000/- investment per month:-

- If you invest 5000 pm for ten years, how much would its value be? Guess? It is Rs. 13.93 Lakhs resulting in close to 2.32 fold capital rise.

- If you invest 5000 pm for 15 years, how much would its value be? It is Rs. 33,84,315, resulting in close to 3.76 fold rise in the capital.

- If you invest 5000 pm for 20 years, how much would its value be? Check it. It is Rs. 75.79 Lakhs resulting in a 6.31-fold rise in the capital.

- If you invest 5000 pm for 25 years, how much would its value be? Hold your breath; It is Rs. 1.64 Crore resulting in a 10.94-fold rise in the capital.

- If you invest 5000 pm for 30 years, how much would its value be? Wow! It is Rs. 3.50 Crore, resulting in a 19.47-fold rise in the capital.

Beginning your SIP Today can be wise if you’re considering securing your financial future and planning for retirement. In the coming years, retirement funding will be a significant consideration in India due to its large young population, which accounts for 65% of the total population. Planning for retirement is of paramount importance as it is a crucial step towards securing one’s future. Relying solely on the support of one’s children might not be adequate. It is essential to believe in oneself, take action today, and strive towards creating the life one desires for oneself in the future.

Beginning your SIP Today can be wise if you’re considering securing your financial future and planning for retirement. In the coming years, retirement funding will be a significant consideration in India due to its large young population, which accounts for 65% of the total population. Planning for retirement is of paramount importance as it is a crucial step towards securing one’s future. Relying solely on the support of one’s children might not be adequate. It is essential to believe in oneself, take action today, and strive towards creating the life one desires for oneself in the future.

If you’re a millennial or nearing retirement, striving for a secure future, “JOYFUL RETIREMENT: The 7-Step Strategy for Healthy, Wealthy, and Early Retirement” could be the perfect solution. With this book, you can feel empowered to create a retirement plan that gives you confidence and peace of mind.

Rate of return -20% pa, Rs. 5000/- investment per month:-

- If you invest 5000 pm for ten years, how much would its value be? Guess? It is Rs. 19.11 Lakhs resulting in close to 3.18 fold capital rise.

- If you invest 5000 pm for 15 years, how much would its value be? It is Rs. 56,71,475, resulting in close to a 6.30-fold rise in the capital.

- If you invest 5000 pm for 20 years, how much would its value be? Check it. It is Rs. 1.58 Crore resulting in a 13.17-fold rise in the capital.

- If you invest 5000 pm for 25 years, how much would its value be? Hold your breath; It is Rs. 4.31 Crore resulting in a 28.75-fold rise in the capital.

- If you invest 5000 pm for 30 years, how much would its value be? Wow! It is Rs. 11.68 Crore resulting in close to 64.89 fold capital rise.

Income Importance

Income doesn’t play such a significant role as most investors think. Even if you invest a small amount but put it into the right place, you can still become a Crorepati. I am talking about the investment phenomenon known as compounding interest, which will continuously increase the value of your holdings.

“Power of compounding is the eighth wonder of the world. One who understands this, earns it……. and one who does not.., pays for it.” ~Albert Einstein.

Do you really desire wealth in your life? Do you dream of becoming a crorepati and wish to make it a reality? Then, let your money undergo the power of compounding.

Start a monthly SIP today. A SIP is a financial planning tool offered by mutual funds that allow you to invest small amounts at regular intervals over a long period. It also allows one to use the power of compounding to generate big returns in a portfolio.

For your benefit, start SIP as early as possible. Today is the best day!

Starting your SIP with a maximum period is the first condition to becoming a crorepati.

In my opinion, “One needs to start early. This will help the investor use the power of compounding for his benefit. Especially over a long period, the difference between starting to invest early versus starting late can make a significant difference to your wealth,”

The benefits of investing in Mutual Funds through SIP are

- Professional Management– Ensures that the best fund managers are managing your money.

- Diversification– Ensures risk reduction thru investing in a broad range of securities.

- Low cost – No entry load. The annual expense ratio is around 2%+

- Convenience and Flexibility

- Ease of Investing – thru ECS or NACH

- Liquidity– Ensures that you get back your money whenever you want.

- Transparent– Ensures you are appraised of the portfolio regularly.

- Extremely well regulated– Ensures that the fund follows a laid down process.

- Tax-efficient – For equity Funds: Long-term capital gains tax in equity funds is 10%, provided the gain in a financial year is over Rs 1 Lakh, and Short Term Capital gains tax of flat 15%.

At last, I would suggest that you go for a long–term SIP that is aligned with your financial goals, not less than ten years so that you can become a CROREPATI.

Follow practical ways to become a crorepati. I hope you all become crorepati and achieve your ‘Financial Freedom.’

Disclaimer: Kindly note that the above illustration is based on the past performance of some mutual funds. Mutual fund investments are subject to market risks. Read all scheme-related documents carefully. Past performance may or may not be repeated in the future. The products do not offer any guaranteed or assured returns whatsoever.

Transforming a Nominal Income into Crorepati Status!

I am a CERTIFIED FINANCIAL PLANNERCM and CHARTERED WEALTH MANAGER®, dedicated to helping my clients achieve financial freedom and experience the joy of being in the HappyMoney Zone. For the moment, I have shared my experience growing up with you because it had a tremendous impact on how I do what I do. If you have a question about your financial situation, please connect me. I would be delighted to try to be of service. Don’t miss any future posts; please subscribe via email.

Hello! Connect with Mr. Rupakumar Pradhan, CFP, CWM, by filling out the form linked below. Form Link:https://forms.gle/dhuYuUp7Uri5cB9U9

“Saving & Happy Money” Read it.