Modern days oxygen means petrol; whether we like it or not, we must accept that petrol rates are high in India. Petrol has become the oxygen of our day-to-day life, and we can’t live and imagine our life without it. But the petrol prices are skyrocketing, which is Rs. 103.19 in Bhubaneswar and Rs. 96.72 […]

Saving for child education is the priority for Indian families without considering the impact of education inflation. Most parents start saving with the low-interest bearing product or making investments on an ad-hoc basis. Rather than creating ad-hoc savings, it would be best if you implemented a plan to meet a child’s higher education needs. […]

Choose wisely! In 2015, I interacted with one of my inquiries for the financial planning service the other day. It was a summer day at Bhubaneswar. At the same time, I have just completed four years as a CFP Professional practitioner. Yes, that time was the most struggling period for me to establish myself as […]

Unlocking the Best Kept Secrets: How to Become a Crorepati with a Nominal Income What does it take to get my first ‘One Crore’ in savings? How to accumulate it? Is it possible to create once crore worth assets in my lifetime? How does one become a crorepati? What are the secrets of achieving it? Is […]

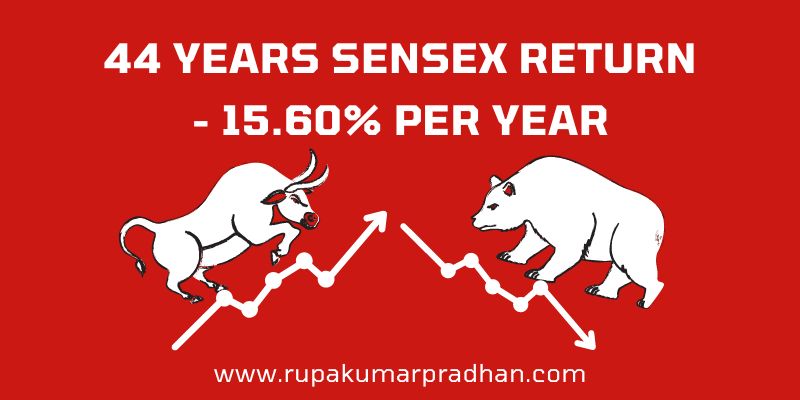

44 Years SENSEX Return- 15.60% Per Year Indian equity market delivered good returns in the last 44 years. As of 31st March 2023, Sensex closed at 58,991.52 points. BSE completed 44 years since 1979-80 (base year). But what is the return per Year? Does the SENSEX give a good return per Year in the long term? […]

Imagine if you could sit and have a cup of coffee with one of the world’s richest men. What if that rich man built his wealth the same way you are building yours – through investing? What if that man were Warren Buffett? What would you ask? Would you try to learn something that would completely change […]

Often, you have heard about words like ‘saving’ and ‘investment’. But did you know that savings and investment are two separate concepts? The words “Saving” and “Investing” are sometimes used interchangeably, but when it comes right down to it, we should be engaged in both, separately, to secure our better financial future. If you’re not […]

5 Reasons Why A Financial Plan Is Important Many of us have specific financial goals that we aim to achieve. These goals may include buying a home, setting up a fund for our daughter’s marriage, saving for our child’s higher education (such as MBA, MBBS, Engineering, etc.), designing a debt management strategy, planning insurance, and […]