Understanding the Power of Compound Interest! Compound interest is a concept that holds immense power when it comes to building wealth and achieving financial goals. It is a fundamental principle in finance, yet many people need help to grasp its potential fully.

So, what exactly is compound interest? In simple terms, it refers to earning interest not only on your initial investment or principal amount but also on the accumulated interest over time. Harnessing the power of compounding can result in significant growth and generate exponential returns over time. By consistently reinvesting your earnings, you can use the compounding effect to amplify your wealth and achieve remarkable financial success. The potential for exponential growth makes it a strategy worth considering for those seeking substantial investment returns.

The concept of compound interest can be best understood through an example. Assume you deposit Rs. 1,000 in a savings account with a yearly interest rate of 5%. At the end of the first year, you would earn Rs. 50 in interest, bringing your total balance to Rs. 1,050. You would earn 5% on this new balance in the second year, resulting in an additional Rs. 52.50. As years go by and this cycle continues, your money starts working for you even harder as compounding returns kick in.

The true power of compound interest lies in its ability to generate wealth over long periods. The more time your money has to grow and compound, the more significant its impact. Starting early and being consistent with your investments can make a substantial difference in achieving your financial goals.

1. Accelerated Wealth Accumulation

Accelerated Wealth Accumulation: Growing Your Money Faster

In today’s fast-paced world, accumulating wealth has become a top priority for many individuals. Whether planning for retirement, saving for a dream vacation, or simply looking to secure your financial future, growing your money faster is undoubtedly appealing.

Compound interest is a magical tool that can significantly accelerate your journey to wealth accumulation. By harnessing the power of compound interest, your money has the potential to grow exponentially over time. As you reinvest your earnings and continuously earn interest on the initial principal and accumulated interest, you’ll witness your wealth multiplying at an astonishing rate. It’s a tried and tested strategy that has helped countless individuals amass substantial financial success. Don’t underestimate the power of compound interest – it can be the secret ingredient to achieving rapid wealth accumulation.

To truly understand the potential of compound interest in accelerating wealth accumulation, it’s essential to utilize tools such as a compound interest calculator and familiarize yourself with its formula. These resources allow you to input variables such as initial investment amount, interest rate, and time frame to see firsthand how compounding can magnify your returns.

Imagine starting with a modest sum and consistently contributing to it over time, with compounded returns working in your favor. The results can be astounding! With discipline and a long-term perspective, even small contributions can lead to significant wealth accumulation.

It’s important to note that accelerated wealth accumulation is not an overnight process; it requires patience and consistency. However, by understanding and leveraging the power of compound interest through proper financial planning and smart investments, you can achieve your financial goals faster than ever before.

Compound interest can have a significant effect on your savings and investments. To truly understand its potential, exploring real-life examples of compound interest in action is helpful.

One typical example is investing in a diversified equity mutual fund. Assuming you invest Rs. 10,000 in a diversified equity mutual fund portfolio with an average annual return of 8%. Over time, thanks to the power of compounding, your investment can grow significantly. After ten years, your initial investment could grow to around Rs. 21,589. And after 30 years, it could reach an impressive Rs. 100,626.

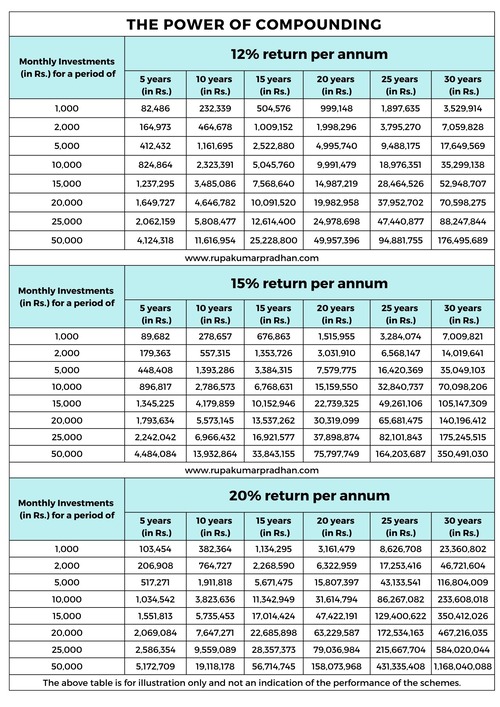

Observe the table below to understand how compounding interest can generate massive wealth. The table encompasses interest rates (12%, 15%, and 20%) and monthly investment amounts across 5, 10, 15, 20, 25, and 30 years. Remember that this is only for illustrative purposes and not an indication of the performance of any scheme.

Disclaimer

Mutual Fund investments are subject to market risks; read all scheme-related documents carefully. The NAVs of the schemes may go up or down depending upon the factors and forces affecting the securities market, including fluctuations in interest rates. The past performance of the mutual funds is not necessarily indicative of the future performance of the schemes.

Another example is retirement savings through a retirement account such as an NPS account. You can see substantial growth in your retirement savings by consistently contributing and taking advantage of compounding over several decades. If you contribute Rs. 500 per month to your retirement account with an average annual return of 7% for 30 years, you could save over Rs. 613,543.

2.Long-Term Financial Security and Independence

Retirement planning with compound interest is crucial for achieving long-term financial security and independence in today’s uncertain economy. By reinvesting earned interest, compound interest can grow your money over time. With consistent investment, you can achieve significant long-term financial security.

Compound interest is a highly advantageous strategy for retirement planning. By starting early on, one can enjoy the benefits of their money growing and accumulating over time.

Compound interest is essential for securing passive income during retirement. Your investments will grow over time, supplementing other income sources and ensuring a comfortable lifestyle. This is crucial for reducing dependence on traditional pensions and social security benefits.

Compound interest is an essential tool for achieving financial independence and flexibility. It guarantees security and enables individuals to pursue their personal passions with ease.

Planning for retirement with compound interest is the foundation for long-term financial stability and independence. By utilizing compounding returns over time, you can amass substantial wealth and enjoy peace of mind and freedom during your golden years.

If you’re a millennial striving for a secure future, “JOYFUL RETIREMENT: The 7-Step Strategy for Healthy, Wealthy, and Early Retirement” could be the perfect solution. With this book, you can feel empowered to create a retirement plan that gives you confidence and peace of mind.

– The Importance of Starting Early:

Starting early with investing can have a significant impact. Investing for the long term is crucial if you want to secure your financial future. Doing so provides a fantastic opportunity for steady and sustained wealth growth.

One of the key advantages of starting early with investing is the power of compounding. Individuals can benefit from exponential growth over an extended period by allowing investments to grow and reinvesting any returns. It means that even small amounts invested early on can accumulate into substantial sums in the long run.

Starting early allows investors to take advantage of market fluctuations and earn higher returns over an extended period. Staying invested long-term provides the opportunity to ride out short-term volatility.

Starting early allows for a longer investment horizon, providing more investment options. Investors who invest early can choose investments that align with their financial goals and risk tolerance. They can explore different asset classes, such as stocks, bonds, or real estate, and diversify their portfolio accordingly.

Starting early develops financial discipline and good habits. It fosters saving and investing for the future rather than immediate gratification, setting a foundation for long-term success.

Comprehending and utilizing compound interest’s power to attain financial victory and guarantee a flourishing future is vital. It enables individuals to maximize their money’s potential and achieve long-term benefits.

Investing in assets that generate compounding returns, such as stocks or mutual funds, is crucial for long-term wealth accumulation and retirement planning. It is essential to maintain consistency in building your financial future. It’s time to take control of your finances and start investing wisely.

“Compound interest is the eighth wonder of the world. He who understands it, earns it… he who doesn’t… pays it.” ~Albert Einstein

The beauty of compound interest lies in its ability to exponentially increase wealth through reinvesting earned returns. As interest compounds on both the initial investment and any accumulated earnings, the growth rate accelerates significantly over time. This compounding effect can make a substantial difference in one’s financial journey.

Individuals can take full advantage of compound interest by starting early and staying consistent with long-term investments. The earlier one begins investing, the longer their money has to grow and benefit from compounding returns. Patience and discipline are vital in harnessing this powerful tool for financial success.

Understanding and utilizing compound interest is essential for anyone seeking financial success. By embracing long-term investing strategies that capitalize on this phenomenon, individuals can accumulate wealth steadily over time and ensure a comfortable retirement. So start today, invest wisely, and let the power of compound interest pave your path to financial prosperity.

Unlock the Magic of Compound Interest and Multiply Your Wealth!

I am a CERTIFIED FINANCIAL PLANNERCM, CHARTERED WEALTH MANAGER®. For the moment, I have shared my experience growing up with you because it had a tremendous impact on how I do what I do. If you have a question about your financial situation, please connect me. I would be delighted to try to be of service.

Don’t miss any future posts; please subscribe via email.

Hello! Connect With Mr. Rupakumar Pradhan, CFP, CWM Contact Form Link:https://forms.gle/dhuYuUp7Uri5cB9U9

Can Millennials Retire at 60 By Investing Rs 5,000 Per Month?, Read it.