Discover Your Passive Income Potential with Mutual Funds

Discover Your Passive Income Potential with Mutual Funds

Passive income is a concept that has gained significant attention in recent years, and for good reason. It allows individuals to generate income streams that require minimal effort or active involvement. One can unlock a world of financial independence and wealth creation by understanding passive income and its potential.

Passive income is generated from investments or ventures that don’t need constant supervision or active participation. Unlike traditional forms of income, such as salaries or wages, passive income allows individuals to earn money. At the same time, they sleep, providing financial security and freedom.

One common source of passive income is investment income. This can come as stock dividends, bond interest, or real estate property rental income. By strategically investing in assets that generate consistent returns over time, individuals can create a reliable stream of passive income.

Achieving financial stability and independence can be challenging, but passive income offers a promising solution. It can provide a source of income that covers living expenses without solely relying on active work, which can be a great relief. The advantages of having a source of passive income are immeasurable for individuals seeking financial stability.

I’m excited to share a practical example of how one of my clients earned passive income through mutual fund investments. It’s always great to see people achieve financial success, and I hope this story inspires you, too. Seeing that the client is still committed to investing and earning passive income, even amid the COVID-19 market downturn, is inspiring.

Are you searching for a reliable and steady stream of passive income? If so, mutual funds are definitely worth considering. Let’s look at mutual funds and how they can help you earn passive income.

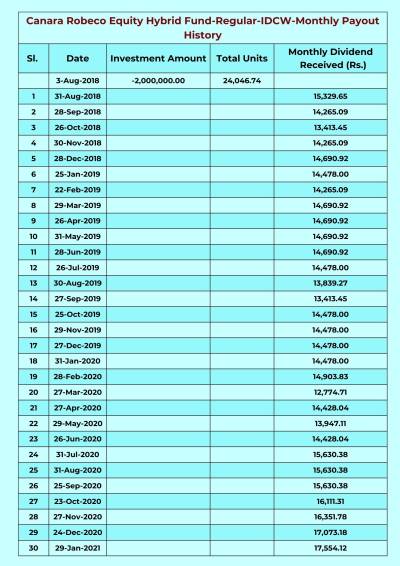

Investment Amount of the Client

In August 2018, the client invested Rs. 20 lakhs in a monthly dividend-paying mutual fund that was recommended to meet his diversification and monthly needs requirements. The fund name was Canara Robeco Equity Hybrid Fund-Regular-IDCW (Income Distribution Cum Capital Withdrawal) –Monthly payout option.

Investing wisely is crucial for financial growth, and the decision to invest in Canara Robeco Equity Hybrid Fund-Regular-IDCW (Income Distribution Cum Capital Withdrawal) – Monthly payout option was a step in the right direction. With an investment of Rs. 20 lakhs made in August 2018, this mutual fund was recommended to meet his requirements for diversification. While he has made investments in various equity-diversified funds that offer monthly dividend payments, Discussing the track record of all these funds would be overwhelming and confusing. Instead, I have chosen to focus on one fund to provide you with a clearer understanding of how it works.

The Canara Robeco Equity Hybrid Fund offers a unique combination of equity and debt instruments, providing him with the potential for capital appreciation and stable income. He has ensured a regular stream of dividends to supplement his income by opting for the monthly payout option.

The client invested Rs. 20 lakhs on August 3, 2018, and August 27, 2018, with Rs. 10 lakhs on each investment date.

On August 3, 2018, our esteemed client was delighted to receive a significant number of units totalling 12,133.2360. These units were acquired with a substantial investment of Rs. 10,00,000 after deducting nominal transaction charges of Rs. 100, which is Rs. 9,99,900. The Net Asset Value (NAV) price on that date stood at Rs. 82.41.

On August 3rd, 2018, (Rs. 10,00,000 – Rs. 100 transaction charges) = Rs. 9,99,900 /Dividing this amount by the NAV price on August 3rd, 2018, which is 82.41 = 12,133.2360 units.

On August 27, 2018, our esteemed client was delighted to receive a significant number of units totalling 11,913.4990. These units were acquired with another substantial investment of Rs. 10,00,000 after deducting nominal transaction charges of Rs. 100, which is Rs. 9,99,900. The Net Asset Value (NAV) price on that date stood at Rs. 83.93.

On August 27th, 2018, (Rs. 10,00,000 – Rs. 100 transaction charges) = Rs. 9,99,900 /Dividing this amount by the NAV price on August 3rd, 2018, which is 83.93 = 11,913.4990 units.

He has received a total of 24,046.7350 (12,133.2360 Units + 11,913.4990 Units = 24,046.7350 Units) units of the Canara Robeco Equity Hybrid Fund-Regular-IDCW-Monthly payout option. He used to receive dividend payouts on these units regularly each month.

Regular Passive Income

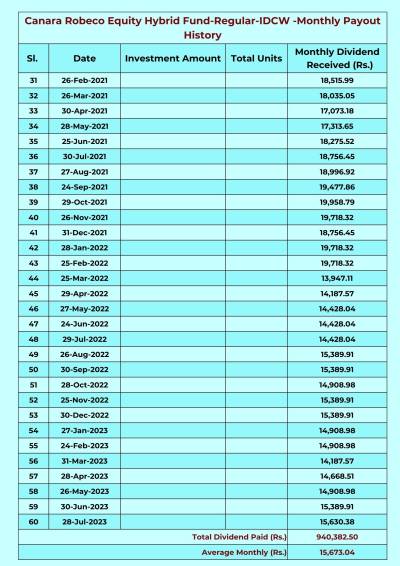

Please refer to the tables (Table One starting the dividend-paying date -31st August 2018 and Table Two starting the dividend-paying date -26th Feb 2021) below for the dividend dates and payment history of the Canara Robeco Equity Hybrid Fund-Regular-IDCW-Monthly payout option over the past five years:

The dates and payment amounts will vary and should be obtained from the official sources or the fund provider.

He has received Rs. 940,382.50 in dividends over the past five years from the Canara Robeco Equity Hybrid Fund-Regular-IDCW-Monthly payout option. While the dividend amount may have varied from month to month, the average monthly payout is an impressive Rs. 15,673. This consistent and substantial dividend stream makes it an attractive investment choice for those seeking regular income.

Imagine a future where your investments flourish and grow effortlessly. We are pleased to inform you that the value of the scheme mentioned above has now reached a total of Rs. 21,21,402.96 (on 22nd August 2023) without considering the monthly dividends received. This is based on the calculation of 24,046.7350 units multiplied by the current NAV price of 88.22. We want to acknowledge the fund’s performance and diligence in managing this scheme. If you sell the units on August 22, 2023, you will receive Rs. 2,121,402.96.

(24,046.7350 units x 88.22 NAV Price) = Rs. 21,21,402.96

Investing in funds can be a lucrative way to grow your wealth. However, it’s essential to accurately calculate and analyze the returns on your investments. If you were to calculate the return on this particular fund until August 22 2023, you would find that it stands at an impressive 10.70%. This figure, known as the XIRR or extended internal rate of return, considers both the timing and amount of cash flows in and out of the fund. With such a promising return, it’s clear that this fund has delivered strong performance and has the potential to continue doing so.

Disclaimer: Mutual Fund investments are subject to market risks; read all scheme-related documents carefully. The NAVs of the schemes may go up or down depending upon the factors and forces affecting the securities market, including fluctuations in interest rates. The past performance of the mutual funds is not necessarily indicative of the future performance of the schemes.

During the COVID-19 pandemic, the Canara Robeco Equity Hybrid Fund-Regular-IDCW-Monthly payout has consistently performed and provided monthly dividends.

While many investors faced uncertain times and experienced a decline in their portfolios, this fund has managed to navigate the challenges and deliver steady returns. Its unique ability to adapt to market conditions sets it apart, ensuring that investors receive a steady stream of income each month.

Even during months when the dividend amount may be lower than usual, this scheme has proven its resilience by consistently providing income regularly. This stability is precious in times of uncertainty when investors seek reliable sources of income.

The Canara Robeco Equity Hybrid Fund-Regular-IDCW-Monthly payout option offers a balanced approach, investing in equities and debt instruments. This diversification strategy helps mitigate risk while still aiming for long-term capital appreciation.

If you’re a millennial or nearing retirment, striving for a secure future, “JOYFUL RETIREMENT: The 7-Step Strategy for Healthy, Wealthy, and Early Retirement” could be the perfect solution. With this book, you can feel empowered to create a retirement plan that gives you confidence and peace of mind.

If you’re a millennial or nearing retirment, striving for a secure future, “JOYFUL RETIREMENT: The 7-Step Strategy for Healthy, Wealthy, and Early Retirement” could be the perfect solution. With this book, you can feel empowered to create a retirement plan that gives you confidence and peace of mind.

This impressive figure is a testament to the potential for financial success that awaits those who invest wisely. With such remarkable growth, it’s clear that this scheme holds tremendous promise for individuals seeking to build their wealth and secure their financial future. Don’t miss out on this incredible opportunity – seize the chance to witness your investments thrive and prosper like never before!

Investing in funds can be a great way to grow your wealth and achieve your financial goals. However, it’s essential to understand the risks involved before making any investment decisions. The information provided here is for illustration and educational purposes only. Investing in any particular fund should not be taken as a recommendation.

Welcome to our blog, where we aim to provide valuable insights and educational content on various investment opportunities. Today, I discussed a fund, but I want to clarify that I am not recommending it for investment purposes. Instead, I aim to educate and inform our readers about its features, risks, and potential returns. Our goal is to enhance your understanding of different investment options and empower you to make informed decisions in the future.

“Never depend on a single income.” ~Warren Buffet

To make informed investment choices, we strongly advise seeking professional help from a qualified financial advisor. They have the expertise and knowledge to assess your individual circumstances and guide you towards suitable investment options.

By consulting with a professional, you can gain valuable insights into the potential risks associated with specific funds. They will consider factors such as market volatility, economic conditions, and fund performance history to help you make an informed decision.

Remember, investing involves inherent risks, including the possible loss of capital. A professional advisor can ensure that your investments align with your risk tolerance, financial goals, and time horizon.

Before investing in any fund or financial product, we encourage you to take advantage of the expertise offered by professionals who can provide tailored advice based on your unique situation. Your financial future deserves careful consideration and planning – seek professional assistance today!

Multiply Your Wealth Effortlessly with Mutual Investments!

I am a CERTIFIED FINANCIAL PLANNERCM and CHARTERED WEALTH MANAGER®, dedicated to helping my clients achieve financial freedom and experience the joy of being in the HappyMoney Zone. For the moment, I have shared my experience growing up with you because it had a tremendous impact on how I do what I do. If you have a question about your financial situation, please connect me. I would be delighted to try to be of service. Don’t miss any future posts; please subscribe via email.

Hello! Connect with Mr. Rupakumar Pradhan, CFP, CWM, by filling out the form linked below. Form Link:https://forms.gle/dhuYuUp7Uri5cB9U9

Master, The Art of Saving, Starting Now!, Read it.